A transformative and ethical approach to debt

The rising cost of living, fluctuating interest rates, and broader economic factors have contributed to an increase in overdue debts, creating challenges across multiple industries in recent years. As debts age, the ability to recover monies owed becomes harder.

Debt Assist collects debt at any stage of the recovery cycle, from the first reminder through to post-enforcement.

We assist your customers in repaying their debts without adding to their financial burden.

How is Liberata different?

By approaching debt recovery and the causes of debt differently, you can improve future collection rates.

Boost recovery rates

Reclaim more through tailored strategies and multi-channel customer engagement.

Minimise write-offs

Enhanced data analysis informs future write-off decision-making.

Ethical practices

Support vulnerable customers by practising the FSA’s Consumer Duty standards.

Advanced analytics

Enriched customer data identifies the likelihood of repayment success.

Tailored strategies

Recovery approach and communication methods based on debtor’s propensity to pay.

Shared risk model

Work debt collaboratively with confidence in achieving positive outcomes.

Debt Assist – changing the approach to debt recovery

Debts are often sent to enforcement or written off when in-house recovery is exhausted. Debt Assist takes a different approach. Using outbound calls, Smart Advisor assistance, and in-person appointments – alongside email and SMS – we improve customer engagement, boost collection rates, and offer fair repayment solutions.

A fair and ethical way to recover debt

We prioritise an ethical approach to debt collection. Our methods focus on assisting vulnerable customers to pay without increasing their financial burden. We avoid practices that are harmful and distressing to the customer. Through FCA accredited debt advice services and benefits calculators, we empower individuals to manage their repayments. Supporting customers in this way enables them to tackle the underlying causes of their debt and helps prevent it from reoccurring.

Data segmentation that improves customer outcomes

Using enriched customer data and advanced analytics, we segment debtors based on behaviour, demographics, and other key factors. Our propensity-to-pay methods identify those who can pay from those with potential financial vulnerability. This ensures that every case receives a fair approach to improving customer outcomes. At-risk individuals are identified early and given the help they need.

Long-term case efficiency and accuracy

Every debt case we review has a stated outcome and recommendation, even if unsuccessful. Debt Assist enhances your data and ensures its accuracy, helping to optimise the recovery process and reduce manual rework.

By working with customers to implement sustainable repayment plans, the risk of recurring default is reduced, and the long-term management of your outstanding debt pool is more efficient.

Secure and compliant payments

We recommend that payments be made through our secure and regulatory-compliant system to ensure accuracy and efficiency. Every transaction is tracked, and the debt’s progress is monitored. The process minimises errors, reduces duplication, and simplifies reconciliation. Funds are transferred instantly to your organisation.

Informative and transparent reporting

Debt Assist has comprehensive reporting. You receive a clear view of case progression and recovery outcomes. The reports give updates on payments, case actions, and amounts collected. Regular reports are issued via pre-agreed update processes.

Supporting your most vulnerable customers

Balancing effective debt recovery with community and customer care is no easy task. The two often seem incompatible. Liberata’s First Steps programme is essential to our ethical debt recovery solution. We want to give vulnerable individuals the support they need while improving collection outcomes.

First Steps focuses on tailored outcomes for those facing financial difficulties. Every vulnerable customer case is carefully assessed to:

- Determine the appropriate support levels

- Gain access to the correct financial advice

- Receive guidance on digital tools and benefits calculators

- Arrange bespoke repayment plan

First Steps helps to address poverty, under-claimed benefits, and limited digital skills.

Collaborating with organisations like Citizens Advice and using tools such as the Vulnerability Registration Service (VRS), First Steps effectively addresses complex needs. Our ethical and personalised approach helps your customers regain control of their finances and fosters long-term financial independence.

First Steps maintains the trust of your customers while contributing to more substantial recovery rates.

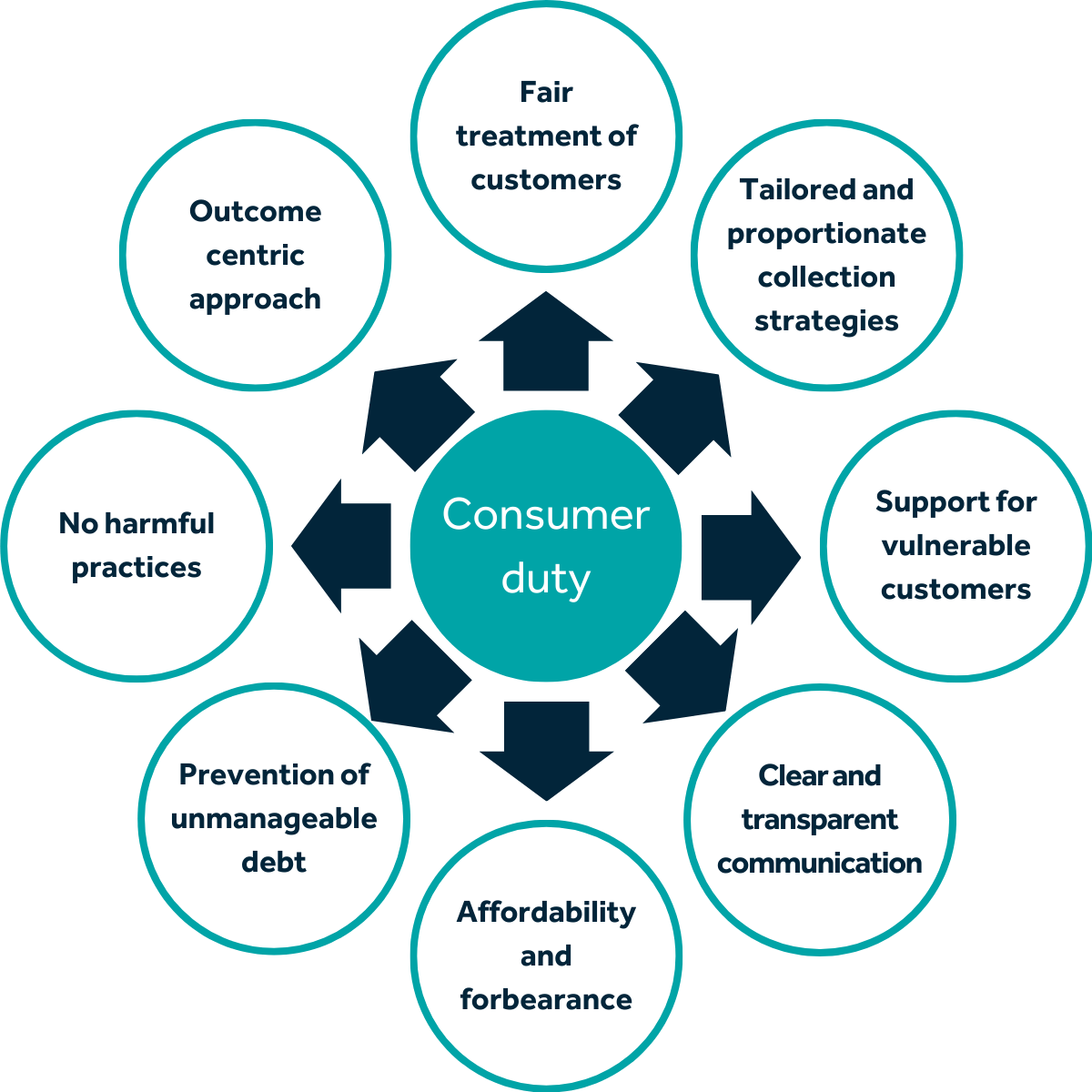

Consumer Duty compliance

We align with the FCA Consumer Duty standards, where applicable, to ensure fair, transparent, and outcome-driven debt recovery. We meet the standards by tailoring repayment plans, communicating clearly, and avoiding harmful practices.

Talk to us about Debt Assist

Multi-sector capabilities

Liberata serves organisations across diverse sectors. We have tailored strategies to tackle unique debt challenges. Debt Assist recovers outstanding debts, meets sector-specific requirements and improves outcomes.

Central Government

Total sector debt of £39bn from DWP overpayments, HMRC arrears, and fines, resolved with compliant, citizen-focused solutions.

Local Government

Debt of £13bn in England from Council Tax, business rates, and housing benefit overpayments, recovered with regulatory expertise.

Financial Services

£11.6bn total debt made of complex arrears, managed with bespoke strategies for high-value debts.

Utilities

Total of £6.6bn debt across the sector in unpaid bills, tackled with customer-centric recovery methods.

Housing Associations

Debt totaling £798m from rent arrears, resolved with compassionate, tenant-focused solutions.

London Borough of Hounslow recovered £1.4m of outstanding social care debt over three years using Liberata’s static debt solution.

“My experience of using Liberata Debt Recovery has been very positive. The Debt Recovery Officer/s have been efficient, engaging and pro-active. The funds obtained by the Debt Recovery Service have far outweighed the cost.”

Read the full case studyHelen Taylor

Head of Service, Adult Social Care, London Borough of Hounslow Council

Peterborough City Council recovers £175,000 of Housing Benefit overpayments

“The service from Liberata was extremely effective and we were surprised by how they managed to engage with citizens in an empathetic manner and recover a significantly higher than expected percentage of the overpayments.”

Read the full case studyEmma Riding

Service Director – Financial Management and Deputy 151 Officer, Peterborough City Council

Your trusted recovery partner

Liberata combines 50 years of expertise with technology to deliver meaningful results for our customers. We collaborate closely with you to provide tailored strategies and achieve effective, ethical debt recovery and sustainable debt resolution. Our dedicated teams ensure smooth implementation and ongoing support.

Our investment in innovative technology enhances operational efficiency and delivers detailed reporting and data-driven recommendations that optimise recovery rates. We are firmly committed to data security and compliance. Sensitive information is managed following GDPR and industry standards.

Explore how Debt Assist can work for you.

Get in touch to learn more and book your free consultation.